Our Focus

Laurel Wealth Planning is an independent, fee-only financial planning firm. As fiduciary advisors, we are legally bound to work in your best interest at all times.

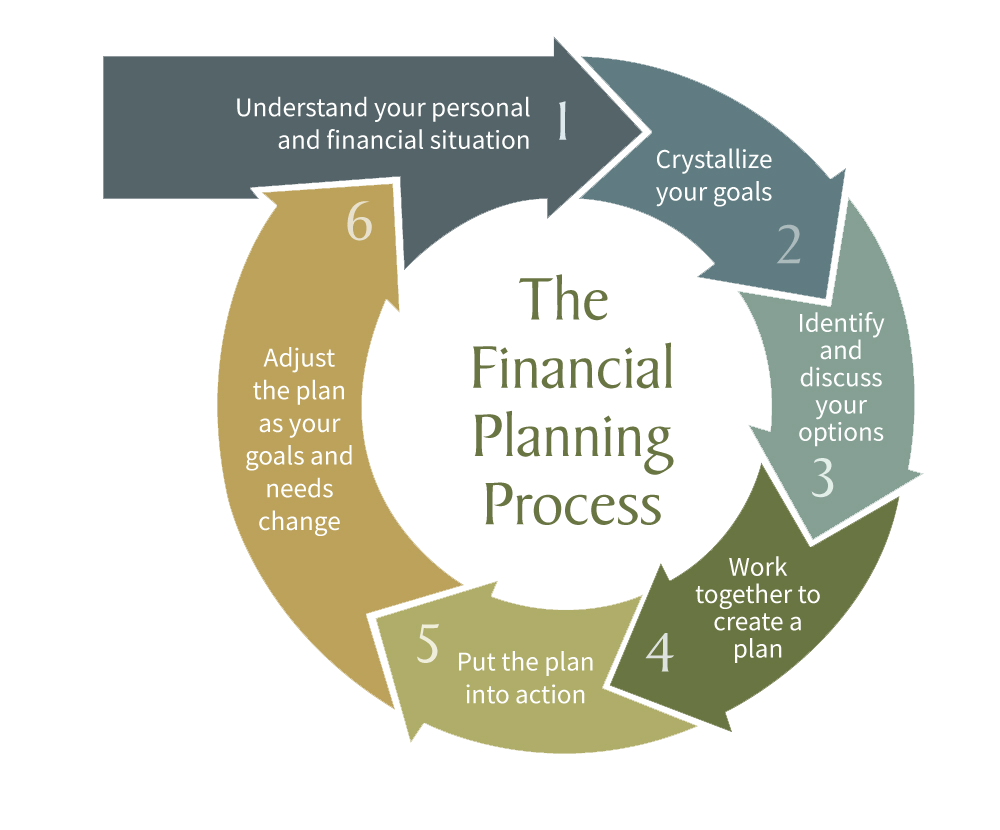

Giving sound, objective financial advice takes experience in investments and tax management. But, even more than that, it takes a holistic approach. Following the six time-tested disciplines of the CFP Board, we look at all aspects of your financial life and connect them in ways that add meaning and value for you.

You are at the heart of your wealth management plan.

Our Client Experience

Confident and uncomplicated. That’s how we want you to feel about your finances and financial future.

We accomplish this, in part, through a high team-member-to-client ratio. Our team’s high level of personal attention enables us to proactively manage your investments and enhance after-tax returns. It allows us to regularly adjust your customized plans, take advantage of opportunities and ensure all your questions are answered.

With Client Care First being chief among our six core values, we work to simplify your life. Our down-to-earth approach to your financials is carried out in coordination with your tax advisor, attorney, and/or accountant.

Our goal is to help you reach your goals.

With this focus on you and your goals, we do the following as part of our comprehensive financial planning process:

- Consider all your investments, even those not with us.

- Calibrate strategies, especially as investment markets reach extremes.

- Counsel you on risks and opportunities so you can make the best decisions for you, based on your needs and preferences.

- Conduct an annual review of tax returns to look for investment tax reduction opportunities.

- Meet with you regularly and communicate with you often.

How to get started

After deep conversations about what matters to you, we build a custom financial plan that incorporates all of the services above. We continually revisit and update the plan, keeping you well-informed and in control of your finances.

Our cost structure is competitive, and there is no cost or tax to transfer assets.

Fill out the form below to request a discovery call.